Sep ira contribution calculator

Consider a defined benefit plan as an. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your.

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

Take Advantage Of Resources For Jackson-Appointed Financial Professionals.

. A Simplified Employee Pension SEP IRA is a retirement plan that allows for higher tax-deductible contributions tax-deferred growth hassle-free account maintenance and a flexible. Learn About 2021 Contribution Limits Today. Ad Help Determine Which IRA Type Better Fits Your Specific Situation.

SEP IRA Contribution Limits The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000. SEP IRA plans are easier to establish than other retirement plans and have lower costs to administer. 5 Keys Steps to a SEP IRA S-Corp Contribution.

For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. How much can I contribute to my SEP IRA.

When you purchase life and retirement. A One-Stop Option That Fits Your Retirement Timeline. Learn About 2021 Contribution Limits Today.

SEPs are elective plans and very flexible. For comparison purposes Roth IRA and regular. They just dont allow very large.

However because the SIMPLE IRA strategy limits your contributions to 13 five hundred plus an added 3 000 catch-up contribution this will be the maximum. Self-Employed As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Ad Discover The Benefits Of A Traditional IRA. Compare 2022s Best Gold IRAs from Top Providers. About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future.

Determine if a SEP IRA is best for your business. And so are we. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. Is SEP contribution 20 or 25 You can contribute up to 25 of an employees total compensation or a maximum. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP. 2022 SEP IRA Contribution Limits For 2022 a self-employed business. The maximum amount that.

Reviews Trusted by Over 45000000. Do not use this calculator if the business employs additional eligible. Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator.

Multiply 184700 by 25 and your SEP contribution is 46175. Simply enter your name. A One-Stop Option That Fits Your Retirement Timeline.

S corporation C corporation or an LLC taxed as a corporation For. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Ad Discover The Benefits Of A Traditional IRA.

Self-employment tax less your SEP IRA contribution. SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an. SEP IRA Calculator To determine how much you can contribute to a SEP IRA based on your income use the interactive SEP IRA calculator.

Calculator How much can I contribute into a SEP IRA. A SEP IRA contribution calculator is also great to use if you already have a SEP and are thinking about hiring employees. SEP IRA Simplified Employee Pension Plans SEP IRAs help self-employed individuals and small-business owners get access to a tax-deferred benefit when saving for retirement.

Individual 401 k Contribution Comparison. Based on how much you contribute to your own account the.

Qchjsngdqiby1m

The Ira Contribution Deadline For 2021 Is Almost Here Money

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

The Ira Contribution Deadline For 2021 Is Almost Here Money

Sep Ira Plan Br Maximum Contribution Calculator

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Thinking Of Investing This Is Why You Need A Financial Advisor Financial Advisors Investing Financial

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

How To Pay Off 52k In Student Loans In 21 Months You Need A Budget Budgeting Money Habits Debt Payoff

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Advantages Of A Self Directed Ira Infographic Investing Infographic Infographic Financial Savvy

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Simple Ira Edward Jones

Advantages Of A Self Directed Ira Infographic Investing Infographic Infographic Financial Savvy

The Ira Contribution Deadline For 2021 Is Almost Here Money

Ira Contribution Limits In 2022 Simple Sep And Traditional The Motley Fool

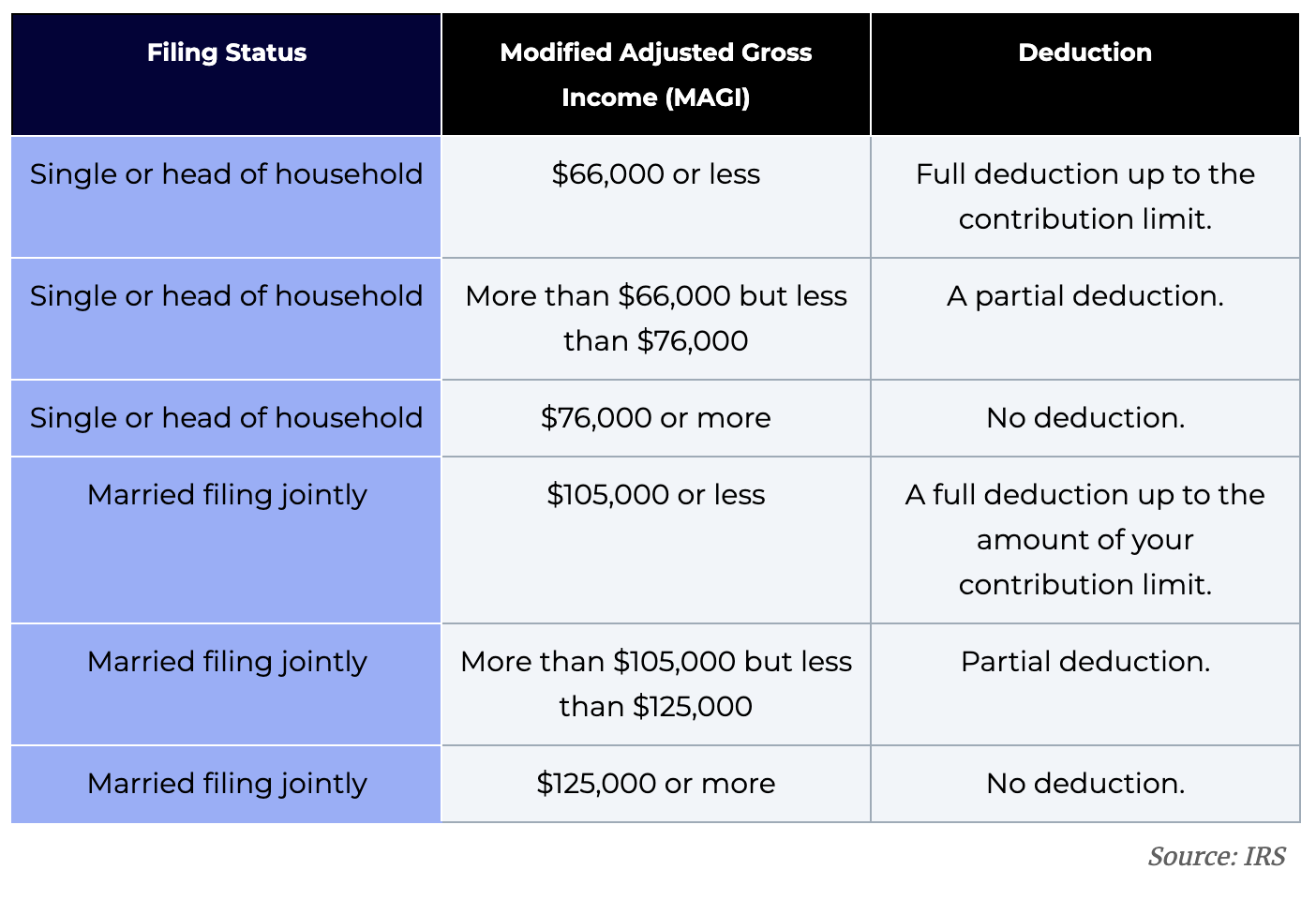

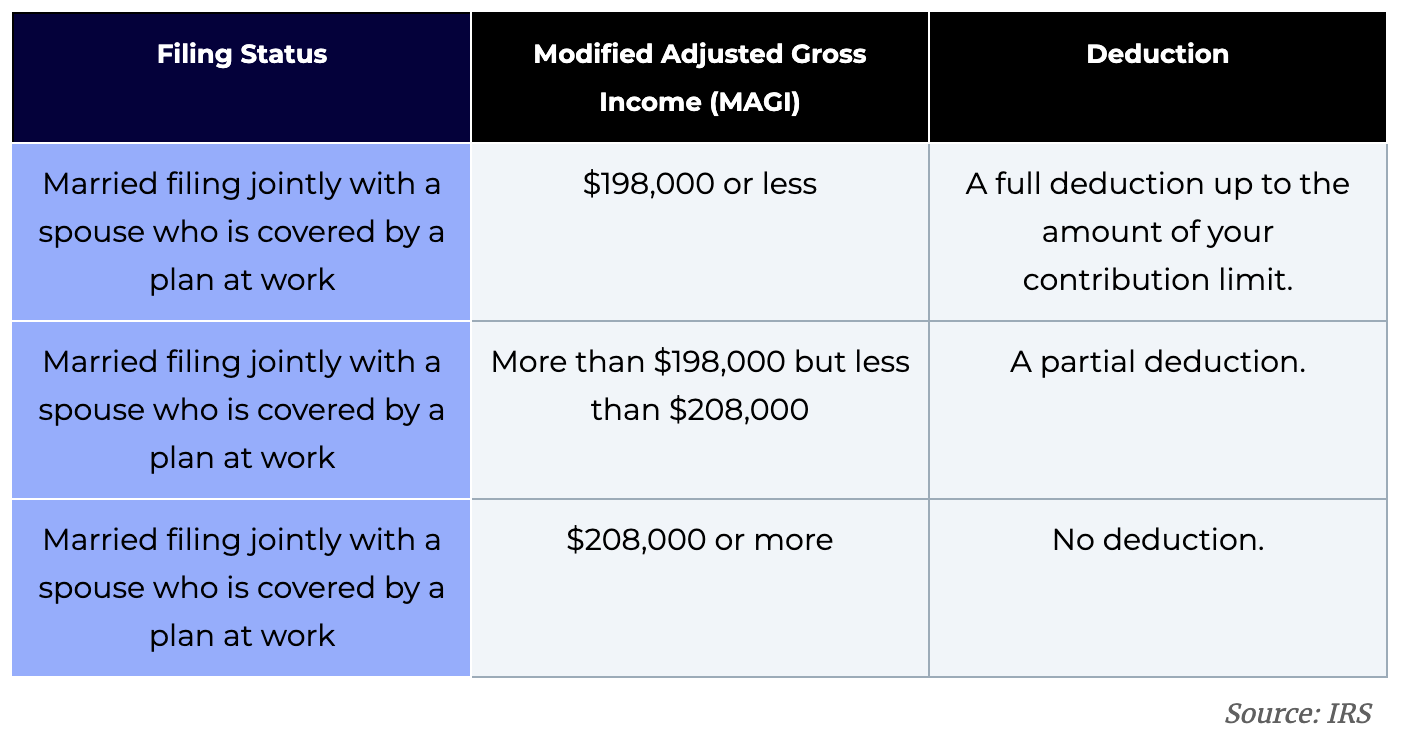

Simplified Employee Pension Sep Ira Contribution Limits And Rules